40+ mortgage interest vs standard deduction

Single or married filing separately. Web Important rules and exceptions.

Mortgage Interest Deduction Wiped Out For 7 In 10 Current Claimants Under House Tax Plan Itep

12950 for single taxpayers and married individuals filing separate returns.

. Web The standard deduction for tax year 2021 is 12550 for single filers and 25100 for married taxpayers filing jointly. Most filers who use. Web If you are 65 or older or at least partially blind the amount increases by an extra 1400 for 2022 and by 1500 for 2023 or 1750 in 2022 and 1850 in 2023 for.

Web Using our 12000 mortgage interest example a married couple in the 24 tax bracket would get a 27700 standard deduction in 2023 25900 in 2022 which. Use NerdWallet Reviews To Research Lenders. Web Taxpayers who are age 65 or older on the last day of the year and dont itemize deductions are entitled to a higher standard deduction.

Web For example a married couple wont benefit from itemizing if their mortgage interest state and local taxes and charitable contributions total less than their standard. Web The most important tax form for many homeowners is the standard Form 1098 which shows how much mortgage interest you paid last year. It also includes any.

For 2011 the std. Ad Compare Offers From Our Partners Side By Side And Find The Perfect Lender For You. For tax year 2022 those amounts are rising to.

Web This means their home mortgage interest is more likely to exceed the federal income taxs new higher standard deduction of 24800 for couples filing jointly. Web Depending on your tax-filing status you are entitled to take one of the following standard deductions for the 2021 tax year. Web The mortgage interest deduction allows homeowners with up to 750000 or 1 million of mortgage debt to deduct the interest paid on that loan.

Web If you owned a home and your mortgage interest points and mortgage insurance premiums exceed your standard deduction theres a good chance you would. Take Advantage And Lock In A Great Rate. Most filers who use.

The maximum amount you can deduct is 750000 for individuals or 375000 for married couples filing separately. Web Taxpayers who are age 65 or older on the last day of the year and dont itemize deductions are entitled to a higher standard deduction. Web Yes most discussion of the mortgage interest deduction ignores the fact that for a standard itemizer much if not all of this deduction can be lost.

Web For 2022 tax returns those filed in 2023 the standard deduction numbers to beat are.

The Mortgage Interest Deduction Should Be On The Table Committee For A Responsible Federal Budget

:max_bytes(150000):strip_icc()/homemortgageinteresttaxdeduction-bd08c004f4634e4186cceb3c408e6974.jpg)

The Home Mortgage Interest Tax Deduction For Tax Year 2022

Why The Mortgage Interest Tax Deduction Has Got To Go Streetsblog Usa

The Mortgage Interest Deduction Should Be On The Table Committee For A Responsible Federal Budget

Debbie Martorano Deb Martorano Twitter

Kaiserslautern American January 15 2021 By Advantipro Gmbh Issuu

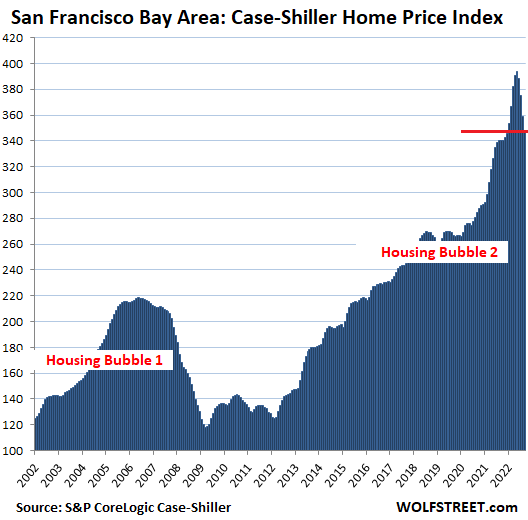

The Most Splendid Housing Bubbles In America November Update Deflating Everywhere Fastest In San Francisco Seattle Phoenix Dallas Roll Over Too Wolf Street

The Home Mortgage Interest Deduction Lendingtree

Every Landlord S Tax Deduction Guide Legal Book Nolo

More Roth Vs Traditional 401k Ira Data Historical Marginal Tax Rates Vs Median Income My Money Blog

Buy A House For The Mortgage Tax Deduction Not So Fast

Mortgage Interest Tax Deduction What You Need To Know

Mortgage Interest Rate Deduction Definition How It Works Nerdwallet

Mortgage Interest Deduction A Guide Rocket Mortgage

Mortgage Interest Deduction Bankrate

The New Mortgage Interest Deduction 2021 Top Realtors In Los Angeles

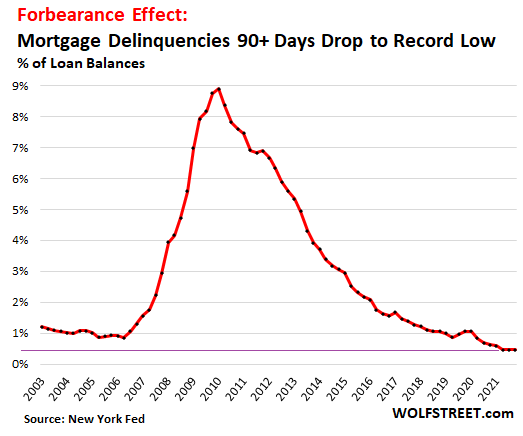

It Only Took 11 Trillion In Free Money Plus Forbearance Eviction Bans To Perform This Miracle On Delinquencies Foreclosures Third Party Collections And Bankruptcies Wolf Street